Quasi-equity

Scale your impact.

About quasi-equity

Do you want to scale your impact?

Do you want to expand your social enterprise or sustainable green business? Do you intend to acquire a social real estate or develop a social housing project? Quasi-equity can help you finance your plans.

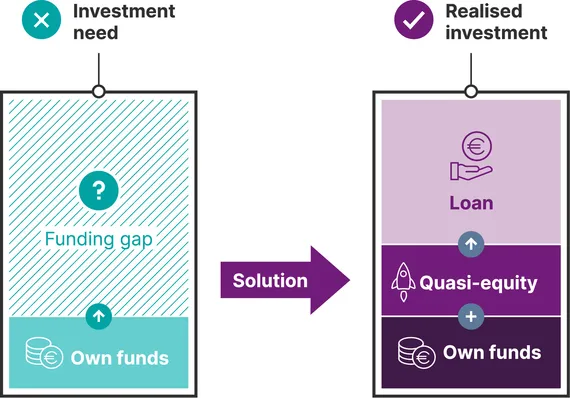

Quasi-equity in the form of a subordinated loan boosts your capital base with no changes to the ownership structure. Therefore, it helps to attract additional funding to realise your investments. It is provided at a fixed interest rate for the agreed contractual maturity and offers an individual repayment schedule. Quasi-equity is subordinated to all other loans and thus improves your financial and risk profile and helps you to attract additional funding.

Benefits of quasi-equity

Covers up to 30% of planned investment

Strengthens your capital base and risk profile

Offers competitive pricing

Helps to obtain additional financing

Allows a flexible repayment schedule

Provides free consulting

We support

Social enterprises and nonprofit organizations:

- Proven business model

- Reached operating break-even

- Proven and measured social impact

Established green businesses:

- Proven business model

- Reached operating break-even

- Proven and measured environmental impact

Social housing and social infrastructure projects:

- Plot of land identified

- Cost assessment prepared

- Business and repayment plan drafted

- New branches & franchise

- New products and services

- Digitalisation

- Covid-19 recovery

- Mobility

- Water

- Energy

- Food

- Health

- Consulting

- Kindergarten

- Elderly homes

- Care

- Social housing

SBS - Social Business Service

Marion and Werner Pitzl have made it their mission to offer people a job perspective, who have no chance in the primary labor market due to integration problems. Their vision is to help people find their way back into working life on a permanent basis - and it is working: One in two SBS employees manages to regain a foothold in the primary labor market.

How to apply

If you want to learn more about Quasi-equity or apply for it, please get in contact with the social banking experts in your country or our Social Finance Holding team. They can professionally advise on your individual funding possibilities.

Application process steps:

1. Expression of interest: get in contact with us

2. Pre-screening: preliminary assessment based on the provided information

3. Personal / online meeting: meeting to discuss the investment

4. Indicative terms (non-binding): deal terms provided

5. Due-diligence and deal structuring: detailed analysis incl. non-financial support needs assessment

6. Binding offer: subordinated and bank loan contracts

Contact

Support & Partners

This financing benefits from a guarantee funded by the European Union under the Programme for Employment and Social Innovation (EaSI).